Saturday, January 23, 2010

Blog#13, Farid - Paper frame and logic

My previous title was “Project management earns value observing from Syariah law.

To start my observation on syariah and align it with the EV theory, I start my reading trough any article which related to syariah financing. My though said at that time; I can start the introduction of paper body by “WHY” I am interesting to PM-EV and syariah. Then found that I would say is that because the rapid growth of syariah financing bank in the last decade to fund a major capital project; and then even non-Islamic country like UK, china, even US start to build their Syariah finance infrastructure. Hmmm,..It could be a good start for my “WHY”.

Then I start to think the body of my paper resources (the WHAT and HOW). After reading several articles I thought that I should not further emerged into financial syariah and its finance’s structures. But I just need to absorb the basic/spirit OR paradigm on how differentiating syariah and conventional financing; which I end up to area set of syariah’s prohibitions (1):

1. Transaction in un-ethical goods and services

2. Earning return from a loan contract (Riba/Interest/Usury)

3. Compensation based restructuring of debts;

4. Excessive uncertainty in contracts (Gharar)

5. Gambling and change-based games (Qimar)

6. Trading in debt contracts at discount, and;

7. Forward foreign exchanges transaction.

To start my observation on how to align this with PM-EV; then I come out with email to mentor a couple month ago (Nov 27, 2009) asking on what the different between PM-EV with conventional PM. the answer that PM-EV the different to conventional PM is only capability to have “real-time” measurement so it could give us “early warning” on how healthy our project is.

To close the loop, I am focusing on the important of PROMPT payment seeing from syariah. By ability of EV to measure the “EARN” then there is no reason to delay on payment. Once, because the obligation has delivered then is ask by syariah to prompt payment the work “before the sweat is drying off”. Also, in addition, prompt payment will prevent factoring invoice practice.

So my paper final paper tittle will be more narrowing to “PROJECT MANAGEMENT: EARN VALUE AND PROMPT PAYMENT PRACTICES OBSERVED FROM VIEW OF ISLAMIC SYARIAH LAW.

The framing will be; start by introduction on WHY I choose this topic; which I would start on boom of syariah funding in the prject funding. Then continue with introduction to syariah financing and its instrument (e.g. sukuk).

Then I will continue the WHAT by start discussion on syariah prohibiting; and then start the HOW by the reason base on my personal observation, the compatible of EV to syariah compliment project management; and use the prompt payment as a case of dicussion.

Finally close with hypothesis (at the conclusion) that is an opportunity to be fully syariah comply IF any project funded by syariah instrument also run the execution by PM EV.

I hope above frame logically OK, and acceptable for 2500 paper. Please comment then I will continue to build the 1st draft.

B.R, Farid

PS: I probably slow in progressing my paper since I only could work on it in Sat and Sun every week, share with my family time since in the other day I will be full time (even more) to my new job;...adapting to new system.

Cited (1) (4). “Managing financial risks of sukuk structure”, A dissertation of Master of Science, Ali Arsalan Tariq, Loughborough University, UK.

Weekly blog #16: Evaluating current project using Earn Value

This week I completely focus on evaluating my project earn value, yet I might understand bit but compare to last week, I might understand the use of this earn value evaluation.

One thing that I can take from this week is this earn value evaluation is not a running commulative process but it is more like current SPI vs CPI trend to chase the project's progress, either is fast and able to catch up the baseline schedule or not.

But as my previous weekly blog that our current project baseline is just sprading weight equally to the time constraint so what it showed was not accurately right. Therefore, from my side I just want to forecasting the Estimate To Complete cost in order to make a proposal IF my project need an injection fund and how much.

Research stated that 80% project progress might could forecast 10% correct of EAC, therefore it would be wise if the EAC number is taken from 80% project progress, while my current project has 2 baseline cost. It will risen the Budget At Completion due to the 2nd phase might start soon not because we did not count the contigency cost.

This is also come to my mind that, if I want to use this data to my CCC/ CCE paper while my current project progress was not up to 80%, it might bot showing a good accurate data. BUT, the best thing about this Earn Value Evaluation, it can always change to the up most SPI vs CPI, our team i always could advice to the contractor what they have to do to solve within the BAC.

To my TRANSFORMER team, we would be better to focus on our paper. Come on team. Let's go upgrade.

Have a nice weekend everyone. Success for us all!!!

Sent from my iPhone

Friday, January 22, 2010

Nui - 15th blog

I knew that last week is bad week for me. Healthy is not good, No progress on paper work. After chating with you instructor, I motivate myself to put your picture in front of my computer to warning me every day to focus my energy to do the paper. So this week, I set the goal to do it 2 hours & 300 words per day. I can do it for 4 days, let's say quite good. Now I have some progress. You may think why it's so hard for me, YES it's hard for me than reading the book and do exercise. I have little chance to writing the research document for my entire life but now it become familiar to me.

This week I have some progress, I almost finish abstract and introduction but still need some review again because when I wrote abstract in the begining, wording and my thought may not be the same line with current one.

I have decided to continue previous topic with your suggestion, to Develop historical database and apply cost estimation technique which I chose Learning curve and Unit technique to be compared.

Why I chose Learning Curve for this study, because this technique use the historical data to predict the future cost. And it because the work that I select (BSC Expansion) is should have increased efficiency in manhour when repeat the work. As we in network roll out industry, the more efficiency we can do the more that we can get competitiveness over other suppliers or even small subcontractors.

With the comparison of two techniques above (Learning Curve and Unit) so I can evaluate which technique is appropriate for this kind of cost. Then I can make recommendation to my organization.

This topic is the exact problem in my organizaiton because currently we try to feedback plan & actual peformance data to estimation team which should be good but it 's not proper keep data and not really bring it into consideration when do new project planning. So I think and hope that I can do it as example to gain understanding concept and real develop to be useful.

As I promise, I will submit my lastest version of my paper to you within this weekend.

Don't expect too much from me, I try my best now.

Saturday, January 16, 2010

Blog #15, schedule management

I am trying the new method for me to write the blog from my gadget handheld in order not always attached to my computers whether in my house nor my office, which I have been doing for these 4 months.

For last couples of weeks I have been stressed out because I have no long holiday like common people have during change year event. I only have holiday during red date that shown in common calendar. Even my HR manager remind me to get some loose attitude and not working all the time. While it is hard for me to do when I know there is my responsible for me to take care my running projects. Especially during holiday is the perfect time to make project arrangement while most of teachers and students are not in here.

I am not whining or complaining, I am just sharing the situation that I have not more or less.

But lesson learnt that I want to share is, the preliminary project schedule is always open to change. Why? Because when we design and plan the schedule, commonly we divide the weight percentage equally to every week within the time frame not based on WBS or in proper cycle within their step by step dependencies. This is not real while it is ideally will be good, but still is not real.

For me a good project schedule is workable from that we can arrange the resource that we need, human, tools and even construction budget to spent every month.

I know that but the contractor who worked for this project in my organisation did not know that. So what happen actual on site is, from the schedule their work progress is WAY OFF the schedule, but if you see actual on site and sees from item of work remain is getting less. So actually they are not OFF from schedule, even my boss said "you work too fast".

Luckily, in this project we have 2 phases, we divide in 2 in order to balance our finance school year budget in to 2 years. Because they work fast, we already put the next year work into now, so again, this is will level the schedule back to normal speed.

And during these 6 months ahead, I also occupied with another 3 more projects that have a short of period of time. Others said "poor me, because I only has 3 back up resources for these projects" but for me, it is a can do projects because I know my resources skill matrix and we working as a team. Within this year only, my team has manage school projects worth of $7,5 million beside other operational and maintenance projects.

For TRANSFORMER TEAM, I have rolled out my propose working plan which is to stretch questions and mapping schedule into June and change weekly report to monthly report IF team agrees to have exam on June or July 2010.

And the paper assignment will be our main target that need to be finish within this March 2010. So we would not be bother Dr PDG concentration for his new student class group.

And Project Managers need to change their baseline schedule to more realistic target, after that I will submit change order to the client, just like the my reality working procedure.

Have a nice weekend everybody. Remember, Work hard.... Play hard

Sent from my BlackBerry® smartphone from Sinyal Bagus XL, Nyambung Teruuusss...!

Friday, January 15, 2010

Asril's Blog Wk #14

We just recently have the approval for the annual capital budget 2010 from the corporate and starting to develop project execution for all of sustaining projects. One of the major projects, Electric Furnace rebuilds being developed and EPCM contract has been awarded to the foreign contractor. They recently develop the Work Breakdown Structure (WBS) on each major activity i.e. engineering, procurement, construction and commissioning. I found the interesting thing that leads me to write it down to this blog.

The engineering consultant who win this job develop the engineering Work Breakdown Structure (WBS) and seems to me they are developing it with cost-element orientation instead of product-oriented or phase oriented. The Work Breakdown Structure organized around element of cost. Summarizing status of the key area of the engineering design would become difficult or impossible because date would be added from numerous elements of cost legs to obtain a total status for a subject of engineering design.

When I open Humphreys & Associates chapter 2, Work Breakdown Structure page 39, its give a clear view and guidance how the best way to develop Work Breakdown Structure for engineering design. Since the engineering design has a multiple phases, it’s necessary to structure the Work Breakdown Structure by phase. This allows the Work Breakdown Structure to be properly oriented for all phases. The following example illustrates how an engineering Work Breakdown Structure would look according to the Humphreys theory.

I’m still read this chapter and discuss with the consultant on how to develop the best Work Breakdown Structure implemented for this project. I would write in the next blog what is the final result that we agreed and open for comments.

Sorowako January 15th, 2010.

Cited:

Humpreys & Associates, Chapter 2, Definition of Scope (Work Breakdown Structure) Page 29-43

Thursday, January 14, 2010

Andy's blog #13

Continuing to complete my 1st draft paper on last analysis of cost risk assessment and contingency determination, I’d like to brief my research how to apply AACE Recommended Practice in the analysis as written below :

AACE International Recommended Practice No. 41R-08 describes the process known as range, a methodology to determine probability of a cost overrun and contingency needed in the estimate to achieve any desired level of confidence as follows steps :

- Identifying the critical activities and the risks

- Determining the ranges and probability density functions

- Contingency determination and probability overrun - using Monte Carlo simulation

Identifying the critical activities

The root cause analysis and the cost risk score on previous week blog#6 and blog#7 present that the major cost driver of risk category is the lower productivity of equipments which are caused some circumstances such lower physical availability of equipments, ineffective constructability, long haul distance, site complexity , rain season, etc. The variability of equipment productivity result uncertainty or risk condition that drive the overall of project activities cost have a risk to overrun. As the equipment productivity is the parameter used to calculate all activities costing and simulate a risk variable to determine a contingency of project cost.

Determining the ranges and probability density functions

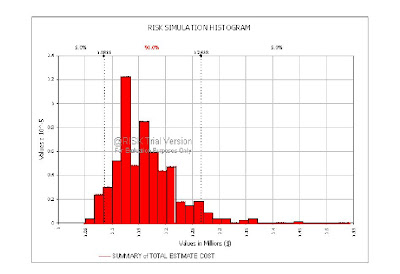

Historical data of equipments productivity that have been worked in the active pit adjacent the project work area since October 2009 to December 2009 is used to determine the ranges and probability density function (distribution) of productivity parameter. The data distribution as shown Figure below shows that probability density decrease is quite symmetrically as a value move the mean where the means is equals to the median. Thus, the normal distribution standard is used as probability density function to run on the simulation.

Contingency determination and probability overrun – by Monte Carlo Simulation

A cumulative probability distribution is more commonly known as an S curve which is usually derived from a simulation such as Monte Carlo can be particularly useful in portraying the uncertainty implications of various cost estimate. While the uncertainty is described in a probability distribution modeled and the generation of statistics requires a random sampling of all possible values. The general approach to simulation using Monte Carlo method is [1] :

- Develop a cost estimate model based on work break down structure

- Select the group for analysis as cost variables

- Identify uncertainty includes select the probability distributions

- Analyze the model with simulation

- Generate reports and analyze information

In Figure above can see the known risks of probability of project cost is range from $1.0855 M at 5 % probability of under run to $ 1.2658 M at 5% probability of overrun. The characteristic of S curve show that the gradient of slope is more gradual shape when approach more than 90 % probability, which means that increasing a certainty level up to 100 % probability would give more increasing on project cost estimated which might be not worth as preference option.

However, there is no specific guideline is considered a best practice to determine a defensible level of contingency reserves as the selection of desired probability actually depends upon the risk attitude of management. A 50% probability might be have equal probability of overrun and under run, also a risk neutral approach to overbalance the corporate capital portfolio that some projects might be overrun while others will under run. Moreover, the contingency reserves are necessary to cover increased cost resulting from uncertainty mining plan in the pit area which affect the project scope and parameter assumption, geotechnical risk, increasing fuel cost and equipment maintenance cost, low production working during rain season, and inaccurate topography data. Refer to the Corporate policy that 10 % is allowance limit for overrun and considering to make a provision for risks unknown as stated above at the time but likely appears as the project progress, a 90% probability is proposed as a desirable level of contingency reserves.

[1] Risk Management, Chapter 31, page 31.6-31.7, Allen C. Hamilton, CCE, Skill & Knowledge of Cost Engineering, 5th Edition Revised, AACE International.

Sunday, January 10, 2010

Asril's Blog Wk#13

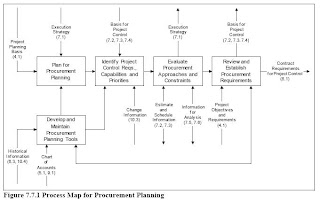

Get back to CCE certification business after busy time during year end closing. Restarting to write the weekly blog, I’d like to briefly share PT Inco capital project process flow how to make a planning for project procurement with a bit comparison with procurement planning on Total Cost Management Framework theory.

Total Cost Management Framework clearly stated that procurement planning is part of the project control planning process that ensures that information about resources (e.g. labor, material etc) as required for project control is identified for, incorporated for and obtained through procurement process. The term of procurement is used in TCMF here in the broad sense of the collective functions that obtain labor, materials, tools, equipment and other resources.

It’s a bit different with PT Inco organization which procurement planning is exactly only looking at the planning for materials & equipment used for the project, it doesn’t include labor and contract. Contract has its own section that looking after contract planning but however on top of the project planning, they are all in the one major planning that we call procurement and contract planning. PT Inco capital project procurement process flow as shows in the picture below is initiated in the Capital Appropriation Request (CAR) development.

CAR document is the contract document which is including all project planning includes procurement planning. CAR document complete with project planning basis, execution strategy, estimate and schedule information. They are basically the input items for procurement planning.

As mentioned early above, procurement planning on the Total Cost Management Framework is the integrate planning include material, equipment, tools, labor and other services. Its more comprehensive compare with current PT Inco organization procurement planning but in general, the theory behind is the same and the different is most likely due to the company organization did not support the planning theory as mentioned in the TCMF.

Looking at the TCMF process map, procurement planning, the input process includes project planning basis, execution strategy, chart of account and information for analysis. The outputs are basic for project control, estimate and schedule, execution strategy and contract & procurement requirement for the project.

Picture 2. Process Map for Procurement Planning

Sorowako January 10th, 2010.

1 PT Inco Project Engineering Business Process, Detail Engineering, Procurement & EWP Issue Page 7 of 15, Author. Muhammad Asril

2 Process Map for Procurement Planning, Total Cost Management Framework, Chapter 7.7 Procurement Planning Page 169

Blog#12 - Farid Maloni - FACTORING INVOICE; is it a new business?

Before start I would to recall on the trade credit. Trade credit is the credit extended to you by suppliers who let you buy now and pay later. Any time you take delivery of materials, equipment or other valuables without paying cash on the spot, you're using trade credit (1)

In fact, actually suppliers don’t like offering trade credit, most have accepted it as an industry standard and have learned how to operate and live with it. In fact, some suppliers have even mastered how to offer trade credit and use it to better position their companies with leading clients (2).

Also last week we can see a simulation on how I a trade credit will have a big impact into cash flow either supplier or client and also positioning in business.

When I do net browsing on trade credit and its related word, I found an interesting issue on factoring invoices; which is I think is set seal to my prejudge I was wrote in my 4th blog on usury. I was said previously that any payment/or business transaction which demanding a 30/60 days late payment term ( as a trade credit) is has potential to direct business performer (client/supplier) make an usury; which is hardly prohibit in Syariah.

Also they said “a Factoring” is an effective form of business financing in which you sell your invoices to a factoring company in exchange for immediate payment. It eliminates the 30 to 60 days that your customers take to pay your invoices and provides you with the working capital you need to run your business (3).

An important result of the using invoice factoring you will get predictable cash flow. Also, factoring eliminates the uncertainty of when you’ll get paid. The Factoring Rates as low as 1.5% Advances as high as 90% (3).

What I can see here that SOMEONE HAS TAKING A BUSINESS OPPORTUNITY; I would say “SHORTIME” LOAN MONEY BUSINESS.

This is what clearly prohibits in syariah as a Riba, that people having beneficial of any return/reward or compensation charge on a loan. Money is considered as a medium of exchange effectively created to be sought not in itself but for other commodities, Thus charging interest on loan is considered unjust since money in considered to be simply an intermediary between goods (4).

In further that they mention using factoring to finance your business has a number of benefits (3); they are:

1. Factoring invoices gives you predictable cash flow. It eliminates the uncertainty of when you’ll get paid by your customers

2. Invoice factoring lines are tied to your sales. Your financing line grows as your sales and your company grow

3. Factoring is easy to obtain and can be set up in days

4. Factoring invoices is ideal for established companies or startups.

So my conclusion on what I wrote start on my in previous blogs on payment to today blogs in factoring; are:

1. Syariah knowledge that “buying/selling” was created by human long-long time ago, basically to fulfill their need. That different people have various skill on creating add value to good/or services which is needed by other people; then it does create needs of “exchange”. Longtime ago people start their “exchange” by “good to good” exchange...or a “good to services” exchanges. Then later money was created to simplify the exchange process; and syariah just acknowledge money as exchanging tool.

2. Syariah prohibit usury or ‘riba” or interest; which taking return/reward on loan.

3. In fact, actually business performer does not like to have a trade credit because it is delaying their right to receive a reward on what their has deliver (good/or services). Of course, for the small business performer, even big performer, it will influence their cashflow. We taking on risk involvement here.

4. The trade credit in form 30/60 days requested from client/buyer/owner; which until now I haven’t get a clear answer what the need to delay payment to 30/60 days.

5. Several supplier which conditioned to run their business in this condition, has smart way too to transfer their “business risk” by charging interest in their interest. So, Syariah start to offended.

6. Actually this is not necessary. The client try to transfer their risk (IMPO) by delaying 30/60 days (using trade credit), but actually the supplier transfer it back within an interest. It creating un-necessary risk circulation. Payment just need to be made as soon as the services/or good delivered.

7. Then the latest, I would say this phenomenon as a “payment risk circle”, which has seen as a business opportunity; by factoring business. This is clearly a usury practice; which even clearer because the factoring business performer loan compensation charge business. But I think even worse, cause the 1st usury practice done by the “smart” supplier which include interest in their invoices, then the 2nd usury practice done by the factoring business.

B/R, Farid Maloni

List of citation:

(1) http://www.entrepreneur.com/encyclopedia/term/82538.html

(2) http://EzineArticles.com/?expert=Marco_Terry

(3) http://factoring.qlfs.com/

(4). “Managing financial risks of sukuk structure”, A dissertation of Master of Science, Ali Arsalan Tariq, Loughborough University, UK.

Saturday, January 9, 2010

Nui - 14th blog

I saw your comment on my last week blog. Frankly, I don't understand it exactly on the first time after I read it. I ask Thao to help me explain what you are going to tell me. Maybe because I don't understand the point that you would like tell me. Now I think I understand most of it.

So I try to scope down what to be my experiment.

I decide to focus on turning the historical data to be useful information. By try to follows with TCM framework, process map 10.4-2 Process map for project historical database management.

I will bring the past project information, collected them by working only quantitative information. From this collection, i will produce project data collection form which data will be normalized before keep into database.

"Data Normalization reduces inconsistencies and anomalies within your data. The firs step is to weep out any projects where the data is deemed to be unusable. There are many reasons why the data would not be accetable:Deviant Accounting and/or Project Controls,Small project,Direct Equipment Purchase,Ad Hoc Project" Cited from Transforming Historical Project Data into useful Information

From the above citation, Data will be cut some part out in order to be consistent and able to analyze it. Then I will construct the spreedsheet to show how historical will be shown out as the database and may put some estimation techniques to calculate estimation cost which provide cost estimation range to estimator. With my belief, this will increase confidence on cost estimation from both estimator and reveiwer.

Scope of my paper will be only BTS or BSC node and quantitative data which will limit of my study and not waste too much time but can be successful and understandable for organization when implementing.

I try to think about thing that relevant to my work and benefit to my organization. And I think this is very good idea as the topic itself and very beneficial to the organization as well if it can be REAL implementation. In Ericsson, we always have been asking about knowledge sharing, I think this is the real one to record and use historical data to be beneficial.

Furthermore, as it is shown in process map aboove, not only quanlitative data, it also qualitative and method and tools.

Friday, January 8, 2010

Andy's Blog #12

Continuing some readings to research on paper topic risk assessment introduce in different terminology and approached on risk analysis methods compared with the Humphreys book which is currently used for my research on the risk assessment.

Humphreys introduces risk analysis are addressed in the three area :

- Technical risk analysis. Some approaches include : Narrative, Qualitative measures, Risk template, Risk Scoring, Risk Scales and Maxwell Risk Matrix

- Schedule risk analysis. Some approached include : CPM analysis and The highest risk using analysis of characteristic cumulative likelihood curve (S-Curve) by using tools PERT, Monte Carlo Simulation or Latin Hypercube.

- Cost analysis. whether using tools such PERT, Monte Carlo Simulation or Latin Hypercube.

Otherwise, AACE Recommended Practice (RP) introduces some methodologies of risk analysis i.e. :

- Expert judgment

- Predetermined Guideline (with varying degrees of judgment and empiricism using scoring mechanisms into complex tables)

- Simulation analysis (primarily expert judgment incorporate in a simulation or analytical model using Monte Carlo simulation) includes approach of range estimating, expected value and parametric model.

- Hybrid Method that combine several or all of the above classes

I’d like to brief what is my understanding in which any relationship between the methodology of risk analysis as mentioned by Humphreys and AACE Recommended Practices (RP) as follows :

The term of ‘Expert” Judgment explicitly means that the judgment must have a strong basis in experience and be backed up by competency in risk management and analysis. It means that most methodology of risk analysis whether stated in the Humphreys and AACE RP are to some extend hybrid combinations employing expert judgment to completed the outcome of analysis whatever the methodology used is. However, this method is highly subject to imposing iatrogenic when the judgment is inconsistent or biased.

Predetermined Guideline which is using scoring scale mechanism is employed in the Technical risk analysis. The using of this methodology is actually required to establish the technical risk analysis which use complex table and definition of scale criteria such Risk scale and Maxwell Scale Matrix.. This table as per shown picture below shows how Predetermine Guideline applied include the criteria scale definition of risk parameter and risk scoring template to develop the risk analysis. Otherwise, expert judgment will require to quantify the probability and severity of risk.

Table Scale Definition and Criteria of Risk Parameters

The expected value method of simulation risk analysis is started with a list of risks. The probability of occurrence of each risk is estimated. Then the cost and schedule impact are estimated where its most basic form can be expressed as follows :

Expected value = probability of Risk Occurring x Impact if it occurs

This approach is adopted in developing Risk Scale Matrix of technical risk assessment. as per shown on Table Risk scale above Where the severity (Impact) factor of cost or schedule times the probability of occurrence is the risk score (Expected value). This recommend practice then addresses the residuals risks that need to be controlled and managed by a Risk Template method. Further the analysis continue to replace the probability and cost or schedule estimated by distributions that are assigned by the team based on their understanding of the risks. Then Monte Carlo or similar simulation program is run that uses these probability and cost distributions as its input simulation. The simulation’s output is a total cost or schedule distribution along with other data designed to support the decision making process.

In Range estimating method of simulation risk analysis is adopted to develop the highest risk of schedule and cost risk analysis by Humphreys. Further, this approach is used to establish the range of the total project estimate and to define how contingency should be allocated among the critical items. The range estimating method of simulation risk analysis is developed as follows :

- Identifying the critical item a list of risks

- Determining the ranges for the critical items include information :its estimated value, the probability that its actual value will not excess its estimated value, its maximum possible value, its minimum possible value.

- Probability density function for each critical item whether using distributions of triangular, double triangular distribution, standard normal distribution, etc.

- Contingency determination and probability of overrun using Monte Carlo simulation.

Palisades software @5.5 Risk for Excel tutorial shows clearly visualization on how range estimating method developed by using Monte Carlo. It could assess in Web site address http://www.palisade.com/. Well I am just getting the trial license and will run some simulations of cost risk analysis and contingency determination by using RP – Range Estimated next week to complete draft of paper.

Saturday, January 2, 2010

Blog#11 Farid - Trade Credit

I would like to say happy New Year 2010 and all the best for all of you. Today, I would like to continue my curious on payment. Now is about trade credit, factoring invoices and observed from syariah.

What is trade credit? Definition from the link I got is an arrangement to buy goods or services on account, that is, without making immediate cash payment (1).

For many businesses, trade credit is an essential tool for financing growth. Trade credit is the credit extended to you by suppliers who let you buy now and pay later. Any time you take delivery of materials, equipment or other valuables without paying cash on the spot, you're using trade credit (1)

When you're first starting your business, however, suppliers most likely aren't going to offer you trade credit. They're going to want to make every order c.o.d. (cash or check on delivery) or paid by credit card in advance until you've established that you can pay your bills on time. (1)

Suppliers don’t like offering trade credit, most have accepted it as an industry standard and have learned how to operate and live with it. In fact, some suppliers have even mastered how to offer trade credit and use it to better position their companies with leading clients (2)

Large creditworthy customers (considered sufficiently sound financially to be granted credit http://www.yourdictionary.com/creditworthy ), such as the government or large companies, will usually demand trade credit as part of their contract negotiations. Some examples of entities that ask for 30 to 60 day payment terms are: Fortune 500 companies, Large and medium sized companies, State government agencies, Federal government agencies (2)

If we try do some simulation on simple trade credit, depending on the terms available from your suppliers, the cost of trade credit can be quite high. For example, assume you make a purchase from a supplier who decides to extend credit to you. The terms the supplier offers you are two-percent cash discount with 10 days and a net date of 30 days. Essentially, the supplier is saying that if you pay within 10 days, the purchase price will be discounted by two percent. On the other hand, by forfeiting the two-percent discount, you're able to use your money for 20 more days. On an annualized basis, this is actually costing you 36 percent of the total cost of the items you are purchasing from this supplier! (360 (20 days = 18 times per year without discount; 18 (2 percent discount = 36 percent discount missed.) (1)

For the supplier, is can be quit risky for the company cash if trade credit is misused. In the other side, it can be a good positioning in business to win the contract if can offer trade credit to valuable clients (2).

From above we I analyze that applying trade credit will have has significant impact into cash flow either supplier (especially new/small supplier) or client and also positioning in business. For small supplier it required extra effort, and mostly see disadvantage for them. As I mention in the previous blog I ever had experience withdrawal of small (but) good -competitive supplier which disagree with the requirement of trade credit requested by client/my company. This is, IMPO, potentially eliminate competitiveness among supplier since only who can provide trade credit can involve and win the tender.

I would say that it can do better if all the services/goods delivery can be done without demanding a trade credit, also in addition to syariah perspective. Because by the fact above trade credit is not expected by supplier (especially new/or small players). The trade credit demand mostly push by clients which is has a thought probably (IMPO) they take an advantages by delaying payment (by as kind trade credit from his supplies).

But the supplier is not fool, since the will transfer those risk to the client by number of interest. Some suppliers have even mastered how to offer trade credit and use it to better position their companies with leading clients (2).

Back to our focus, to suppliers who provide services, project management, construction etc; the PM EV could potentially provide almost “real-time” project measurement, which provides you earn measurement which eligible for payment immediately. If we apply this on the work, immediate measure the work, then immediate pay the claim as per measured, then the trade credit will not popular anymore. (Remember Walmart story in the class, pay the good in the same day).

Also in term of Syariah it will comply with what has been told” pay the work immediate before the sweat is getting dry” (story from Baihaqi) (3).

In the clients perspective, it potentially reduce project capital by paying the work immediate and taking advantages of forfeiting discount.

B/R,Farid,Jakarta

Citation lists:

(1) http://www.entrepreneur.com/encyclopedia/term/82538.html

(2) http://EzineArticles.com/?expert=Marco_Terry

(3) http://www.rahima.or.id/index.php?option=com_content&view=article&id=421%3Aal-arham-edisi-14-a-hak-hak-pekerja-rumah-tangga-dalam-islam&catid=19%3Aal-arham&Itemid=151&lang=en

Nui – 13th blog

This week, I plan to work on the paper. Originally, I plan to write the whole 2,500 words paper in one shot. Unfortunately, I can't do it as I 'm not so genius. And I also realize that my previous topics, both Apply EVM and Evaluating EVM, is quite difficult for me to writing. Why I propose this topic in the begining, as my intention, I would like to really implement EVM in my workplace but it require a lot of information in order to indicate process and procedure to make it for real use. But in my head, I still think about how to figure this out. It require not only actual data from SAP but it also require implementation status from another tool that we use, call "Site Handler", to handle this EVM method. So let's me try later on into work.

Now, I propose new topic about Cost Estimation Tool & Technique to my workplace. As I found that many projects have estimation accuracy not so good. As I read through 3 books (Engineering Economy, Humphrey and Skill & Knowledge), I realize that many techniques are applicable to works and should be use in my workplace such as Cost Risk Assessment for new technology project or even complex one, Escalation Factor for project that handle for long periods, and use factor multiply to direct cost in order to proper provide range of project management cost. Eventually, suggestion on keeping record of the database by separate them as the site type or node type for the further cost estimation development.

During my thinking what I will write, I also try to find other topic around because I'm not sure whether what I propose will be too less content than it should be. So I have tried to find how relation of direct project cost with project management cost from database of closed project as Engineering Economy Ch.3 , Ch.12 or Skill & Knowledge Ch.9. I put data in excel file, and make a graph to find its trend line and relation from the equation. But it seem that information can't really apply to all projects since the database I have only 6 projects with one account that I have worked for. And these projects are differences from each other in term of scope and node type. The actual data sometimes cannot solely exactly be any of a WBS. So I put it down and come back to my previous thought, just find the percentage range of its relation that should be OK from now since the data available is not enough. I just want to make it concrete enough but I couldn't do it.

Now I finished my abstract and starting the introduction part, but not so well progress as my struggling of information as mentioned above. Hope it is good enough to make it pass.

Sorry if this week is not much technical issue in my blog posting.

Subscribe to Posts [Atom]